Global Dollar Liquidity Shortage

Earlier this year, someone shared this article by macro investor Lyn Alden where she discusses the global dollar liquidity shortage. It remains the single most insightful article I've read this year. I would strongly suggest you read it if you have the patience to explore and understand the concepts discussed in her analysis.

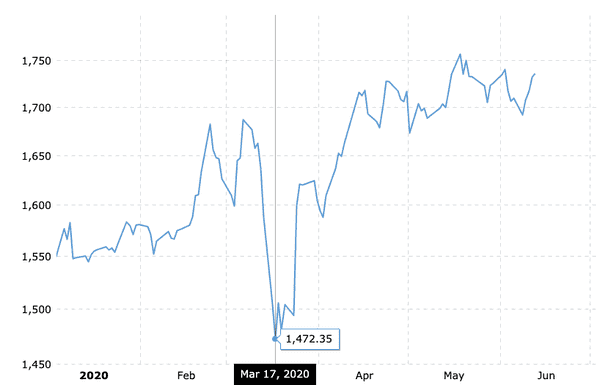

The reason I bring up the liquidity shortage at the start of this writing is because it serves to explain why the market-drop starting February was so sharp. What also made the drop so alarming was that the price of gold fell alongside that of equities. That isn't normal. Precious metals is an asset class that normally thrives under (stock) market volatility and longterm bearish outlooks.

I was so confused when I saw this in early March, I went full cash and refused to reenter the market until I understood what was going on. I lost a lot in potential profit as a result. But this was a principled decision, and I don't regret it.

The United States Dollar (USD) serves as the medium of exchange across many global institutions. As the world economy has grown more quickly than the US economy, there has been an increasing global demand for USD as foreign nations try and hedge their USD-denominated debts by holding more USD in the form of cash or treasuries.

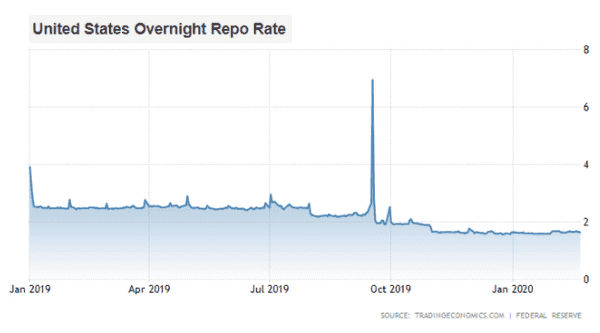

As a result, there aren't enough dollars to go around. During strained periods, particularly when financial institutions have bills due, scarcity drives the price of USD up relative to other assets and across all asset classes. One side effect of this is that investors and institutions become less willing to lend to one another as cash becomes hard to come by. This is a problem in short term liquidity as it's key to the healthy function of the Repo (Repurchase Agreement) Market, which keeps financial institutions operational.

When institutions don't have enough cash to service (pay) their debts and can't access the capital from their peers, they sell their assets to cover these expenses. An increasing fear of an illiquid market further discourages institutions from lending to one another, and in a self-fulfilling prophecy, the whole pond dries up, leading to the mass liquidation of assets if left unaddressed. We saw several spikes in the rate last year with the Federal Reserve stepping in on multiple occasions to prevent the worst outcomes. September of 2019 was the sharpest spike in the Repo rate in the last ten years, and this dollar-starved environment served as the financial backdrop as we ran headfirst into the new decade.

Backstopping the Bond Market

Now, pair this kind of monetary landscape with news of COVID-19, an immense demand and supply shock expected to rock global markets. Following the shift in economic outlook, investors became less willing to purchase corporate debt (i.e. loan money to companies), in fear that companies would go insolvent.

Corporations that operated on the expectation of forever rolling over their debt at low rates, could no longer find investors willing to lend to them at those low rates. Left unaddressed, companies would go delinquent on existing debt as it came due.

Equity valuations dropped sharply in fear of defaults. Moving forward, corporate bonds would be downgraded as the economic climate grew increasingly uncertain.

This poses another problem as institutional investors are not allowed to invest in Junk Bonds. So corporations with downgraded debt would have even less access to capital. Not by coincidence, these at-risk corporations were the same ones that needed financing most.

Yield rates rose across the market alongside perceived risk, which meant financing became more expensive for all companies. The stock market tumbled through February and into March as investors feared a domino of bankruptcies would collapse the market.

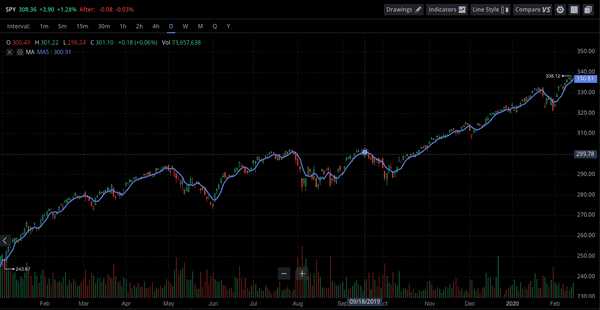

The Federal Reserve stepped in on March 23rd, with an announcement that they would be backstopping the corporate bond market alongside existing Quantitative Easing measures. The Fed answered fear with a giant printer, and the stock market echoed the call with a sharp rebound. This move addressed any concerns over short-term liquidity.

Stonks Go Up?

The market rebounded as expected, but many still called it a dead cat bounce with COVID-19 grinding entire industries to a halt. However, it's important to remember how The Fed was backstopping corporate bonds.

By pouring money into the corporate bond market, The Federal Reserve artificially decreased yields. In other words, the return you could get from buying corporate bonds no longer reflected the underlying risk of lending money to those companies. With treasuries yields also at lows, institutional buyers sought returns elsewhere, particularly from companies with healthy margins and strong balance sheets. Most notably, blue chip tech stocks.

An entire class of investors shifted their sights from corporate bonds to equities as The Federal Reserve signaled to the world that all public companies in the U.S. could stay solvent in the short term. This increase in demand pushed stock prices up from April onward. All the while, SaaS companies started reporting EPS beats for their Q1 performance as many were unaffected by the initial pullback in consumer spending. Investors took note, and demand drove prices up even higher.

As performance continued on its positive trend, retail investors grew incredibly bullish. Stocks receiving outsized attention reached unreasonable revenue multiples, hinting at highly speculative trading for growth and tech stocks (e.g. ZI, ZM). Additionally, the rebound introduced a large influx of new traders who's entire trading experience was encompassed by this recent bull run.

Cue: The Robinhood Brigade

In the modern world of brokerages, Robinhood serves as the gateway drug to trading. It served as my first introduction to the stock market back in college and still holds a place in my heart as an avenue for reckless financial decisions. However, the app is predatory in its treatment of its fledgling traders, and some would argue it's predatory by design.

The mobile app comes with more bells and whistles than that of any other broker but few of the real tools to make an informed trade. By keeping the data to a minimum, Robinhood is able to offer a sleek UI that isn't overwhelming but, instead, incredibly user friendly. From what I understand, their internal design philosophy is modeled after a casino, and there are some incentive structures in its deal with Citadel Execution Services that motivate the company to beckon its user base towards a gambling mentality.

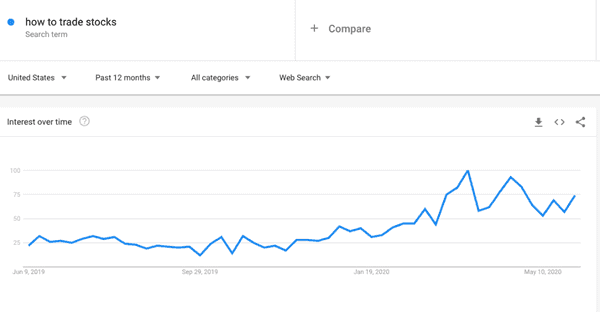

So new traders flocked to the world's friendliest casino app as news of the bull run reached the general public. With zero commission trading, a crisp $1200 bill in hand and nowhere else to spend it in a pandemic-induced lockdown, these traders joined Robinhood by the droves. In March, Robinhood reported an additional 3 million new accounts and tripled its February revenue.

With "by the dip" ringing through their ears and the market marching towards all time highs through Q2, these investors grew increasingly bullish. The Robinhood Brigade drove the price of select stocks through the roof with aggressive bets that institutional investors would never even consider. The stocks they seem to favor are small caps with

- low price per share (options are cheaper)

- steeply "discounted" valuations (from February highs)

- and hype from broad trends or big news.

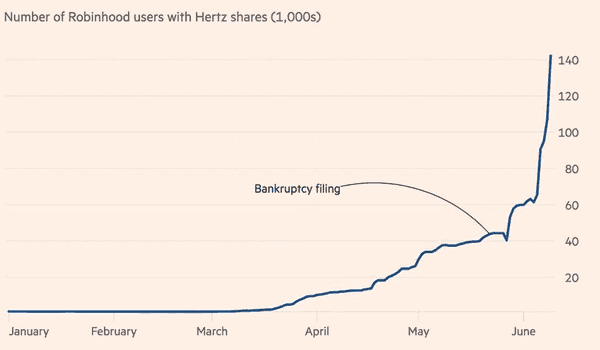

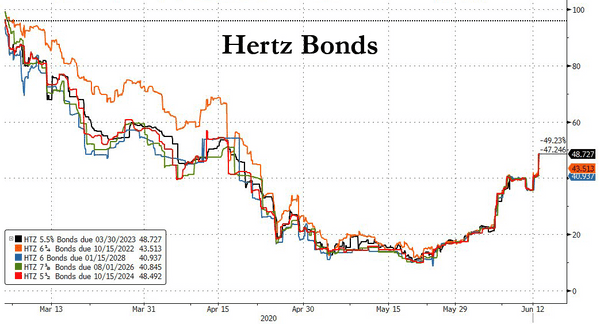

In particular, the car rental company Hertz was hyped up on the hypothesis that cheap debt from The Federal Reserve would lead to their salvation and that the economy was on a path to reopening. What The Brigade failed to understand were that any debt issued by the company still needed to be serviced and that market signals indicated people weren't just jumping back into rentals.

Results have been as horrific as they are hilarious.

It's unlikely The Brigade has enough volume to directly impact the larger market, but with a concentrated force they can drive the price of specific stocks in a way that affects financial algorithms and other retail investors through group psychology.

More importantly, Robinhood's Citadel deal reveals that Citadel pays to execute Robinhood's order flow on their behalf. This incentive structure is indicative of Citadel benefiting off the order flow in some way. At the very least, it's likely they front-run the trades through some loophole in the shade of legal-grey to profit off of induced slippage. This is significant for two reasons: (1) Robinhood's users placing Market orders are getting screwed, ever so slightly on each trade and (2) all behavior on Robinhood is magnified by Citadel's algorithms.

Takeaways

Ultimately, markets are a reflection of flows. Under normal market conditions, prices in the stock market roughly reflect the current and projected state of business in our economy. Under normal market conditions, institutions have an agreed benchmark for valuation ratios. And under normal market conditions, these benchmarks serve as targets for the price of assets.

But what happens outside of normal market conditions? Like when money has nowhere else to go?

Well, we're seeing it now. Last month we saw equities rise to unreasonable valuations, as all alternatives (i.e. other asset classes) became price-saturated based on traditional valuation metrics. Normally, this would call for investors to pull back and convert to cash, but even cash isn't net neutral with The Fed threatening to print trillions at the drop of a dime.

We are living through history. Not just with COVID-19 but with roiling changes to our social, political and technological landscapes. The world has never been so connected in a stumble, and we've reached the end of a business cycle as a country. That, we know. It's quite possible we've also reached the end of a longterm debt cycle.

There has never been a more important time in recent history to understand our economic and financial systems. Luckily, content on the topic is more accessible now than it has be at any other point in history.

So I'm writing to learn. To process and synthesize. These articles are a wonderful bi-product of that education, and I hope you, the reader, find they ease your journey through this new world.